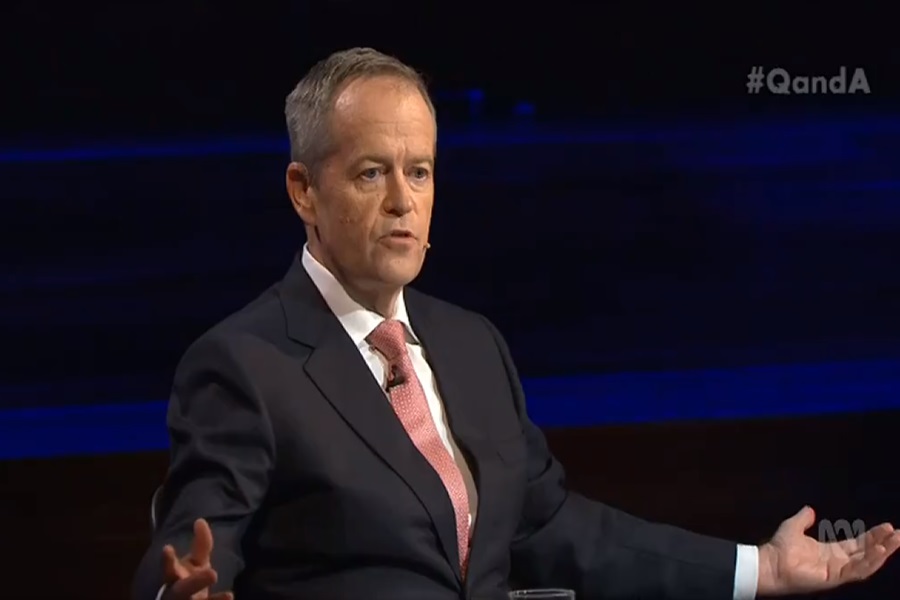

On an appearance on the ABC’s Q&A program, Labor leader Bill Shorten was forced to defend his party’s policies regarding changes to franking credits and negative gearing.

Labor has argued that negative gearing concessions are too generous and make it more difficult for younger people with less capital to enter the property market. Labor’s policy would prevent investors using deducted rental losses to buy existing houses and this is estimated to raise around $2.9 billion over a four-year period.

Speaking to the live audience in Q&A’s Melbourne studio on Monday evening, Mr Shorten reassured voters that these changes were not arbitrary tax increases as the Coalition has warned. He instead described the changes as making the system fairer by closing loopholes.

He added that the changes “won’t apply to anyone who is currently negatively geared,” and that “In other words, you can still keep claiming a loss and claiming credits for the loss you make on your property investment if that’s what you currently do.

“What we’re saying is on January 1 in 2020, new purchases of existing housing won’t be able to claim a Government subsidy.”

He said that “If I’m not giving you a subsidy for you making a loss on an investment property, that isn’t a new tax. It just means you’re not getting a new subsidy.

Mr Shorten also faced scrutiny regarding the unrevealed cost of Labor’s ambitious climate change policies. He argued that the cost of inaction on climate change was far greater in terms of the effect on future generations.